Argentina for gold. 🇦🇷

I've got a pick I like after some recent news and numbers. Plus some boots on the ground Argentina commentary.

Physical gold is sitting around all-time highs.

I’ve even heard it may have another 0 on it in the short term from some of my favourite commentators.

How the hell do you play it? It seems like everyone is talking about it.

Royalty companies, physical, or the miners.

My overall take?

Dunno. I’m just an ex-gold project exploration geologist, and I’ll provide some commentary on my strengths, focusing on what’s caught my eye while being situated in the land of steak, wine, and Javier Milei.

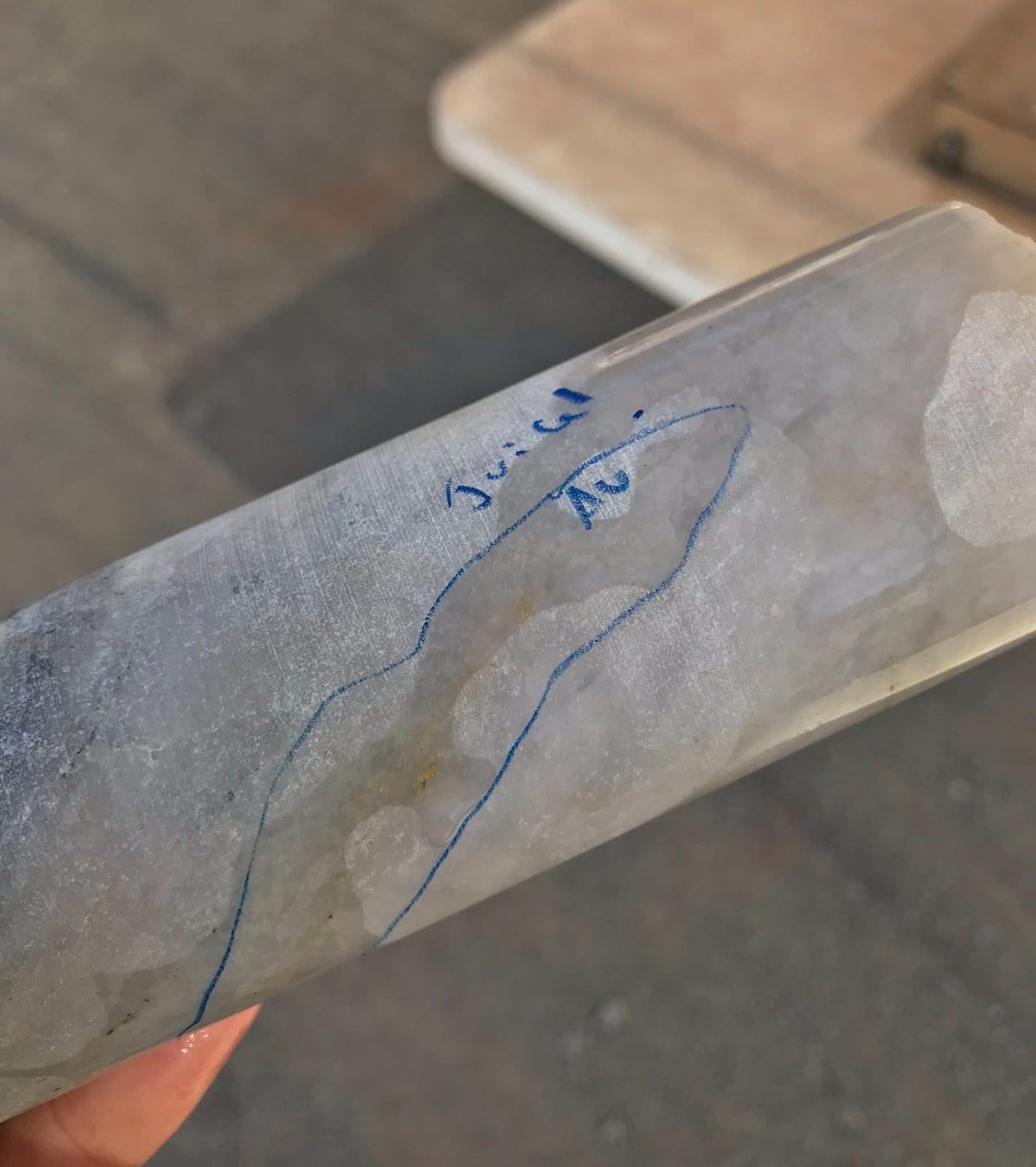

Lately, it’s this.

Argentina’s latest Mining Industrial Production Index was just released this week.

Gold and silver completely stand out at a 17% rise in production in Argentina (YoY) and that’s been driven by production in mining-friendly San Juan Province.

Operating mines of Veladero and Gualcamayo contribute the most.

San Juan, Argentina is damn hot right now.

So, the stock I’m interested in is once again in San Juan, Argentina. After a recent development in the news, I think it stands out as an opportunity if you looking to invest in a gold stock with a strong Argentina beta tailwind.

I’ve also concluded with some Argentina boot-on-the-ground commentary as per usual.