Argentina for Silver. 🇦🇷

The country is literally named after silver. However, newly recovering from Peronia, it doesn’t mine anywhere near its potential. That will change and here are two stocks to watch.

I’ve been digging into silver, and there is no better way than listening to the legendary mining investor Rick Rule.

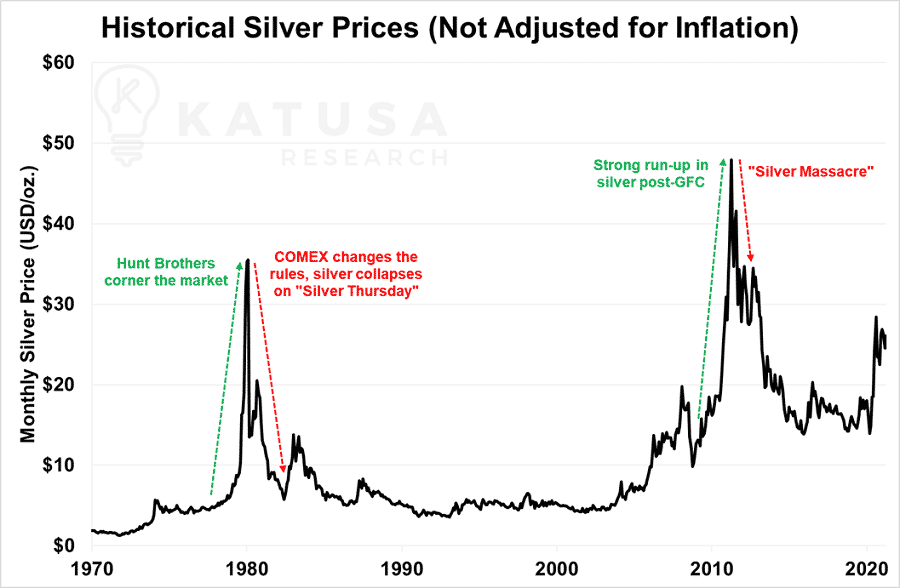

“I own gold for a store of value, but I own silver for capital gain.”

“The upside to silver stocks when they run is truly, truly, truly stupid.”

Rick Rule.

I love how much time Rick gives to YouTube, and this discussion on silver with Antonio at Resource Talks is fantastic.

He doesn’t need to speculate anymore; he has made his fortune, but he seems to do it “out of fun.”

In the last cycle, he often notes that he made 10 baggers on silver stocks, and today he has positioned himself again.

Only 17% of primary silver produced today comes from silver mines. The rest comes from recycling or as a byproduct of other metals—most notably from some of the world’s largest porphyry copper-gold-molybdenum polymetallic deposits.

So what gives silver its value?

First, it is a rare, naturally occurring hard asset—a tangible investment you can hold in your hand that cannot be synthesized or made in a lab.

Silver is one of the most versatile metals for industrial use. It has thousands of applications across a wide variety of industries, from electronics and medicine to batteries, solar panels, and electric vehicles, particularly plug-in electric vehicles, which is where I see the true trend heading.

Silver is also a monetary metal, meaning it has historically been used as a form of money.

Now let’s look at Argentina, whose name is directly derived from the Latin “Argentum” for silver.

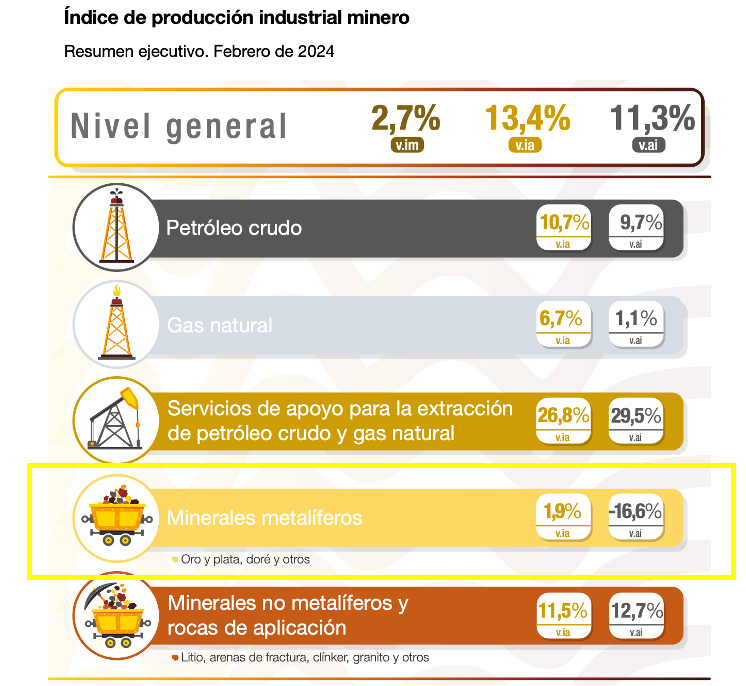

Argentina has significant silver deposits in the ground, but it doesn’t produce anywhere near its potential. However, 2023 was a standout year for silver production.

In 2023, Argentina produced around 32 million ounces of silver, making it the world’s eleventh-largest producer of silver. This represents about 3.5% of the total global silver production for that year.

6-8 million ounces of silver annually come from the Puna Operations, operated by SSR Mining in Jujuy Province, and another 6-8 million ounces come from Cerro Morro in Santa Cruz Province, operated by Pan American Silver.

These deposits are smaller operations that mine high-grade ore. They are seriously dwarfed in terms of silver content compared to the Navidad deposit, also owned by Pan American Silver.

Navidad is one of the world’s largest undeveloped silver deposits, containing an estimated 632 million ounces of silver resources. However, it is currently unmineable as it is located in the heavily anti-mining province of Chubut.

Additionally, some of the undeveloped Argentine porphyry deposits contain significant amounts of silver:

Taca Taca: A porphyry copper-gold-molybdenum deposit in Salta that contains 211.3 million ounces of silver within an indicated resource.

Filo del Sol: High-sulphidation epithermal and porphyry copper-gold-molybdenum deposit in San Juan which contains 147 million ounces of silver within an indicated resource.

There is no shortage of silver in Argentina, but the capital expenditure (capex) required to develop these porphyries into producing mines is in the billions of dollars and depends on many factors.

I am hopeful for the next decade-plus with commodity fundamentals, the Milei government, and the implementation of the new mining and foreign investment-friendly RIGI scheme.

This is all great news for lower capex silver-only projects in Argentina. The price of silver is trading around $30 per ounce at the time of this article, with recent highs reaching $32.10 per ounce.

These silver prices represent a 10-year high, and on the back of an improving Argentine economic tailwind and recently approved mining-friendly reforms, I’ll go through a couple of silver stocks that stand out to me in Argentina.

I will consider their geological potential to add value and review their overall company health.