How does it look for Argentina as a temporary foreigner. 🇦🇷

Invest in Argentina stocks, or just keep playing it as it is? From the perspective of an Australian temporarily residing in Buenos Aires for the geoarbitrage and steaks.

I’m certainly no economist, but I have always taken a strong interest in how countries manage their economies and the level governments play in their prosperity. It is extremely sad and disappointing to see how my country, Australia, is going about destroying its quality of life, destroying our robust energy grid, and protecting a housing market 8.5x the median household income.

But let’s be honest, Australia is not even worth mentioning in the same sentence as Argentina when referring to the management of the economy.

You have to live under a rock to be unaware of the cripling inflation and declining GDP that has stricken the Argentine nation. Basically, resulting from Juan Domingo Peron (Peronism) coming to power in 1946 and nationalising key profitable industries, incorporating large social programs, printing money, and creating a useless public service sector. His version of socialism. The current government here in Argentina today is a version of Peronism. Mind-blowing when you observe the above GDP figure.

Argentina is currently experiencing an inflation rate of 115% YOY (the real inflation rate is much higher) and has a poverty rate of 40%. Over time, Argentina has elected politicians on the opposite side to the Peronists, but the Peronists always seem to end up in power again. After some necessary hardship has been enforced on the economy, people always go back to voting for the socialists.

Argentines are clearly fed up with the current system, and it may be all about to change here in October. Self-described anarcho-capitalist (free market advocate) Javier Milei recently dominated the election primaries. The final verdict on who will run the country is to come in October but could be delayed until November if there is a head-to-head in the race.

I can’t help but love Javier, even though his policies could lead to a more expensive Argentina for me. As an Australian and product of a free market capitalist system, I am hugely in favour of this system, because the road map shows it leads to prosperity.

I’m too much of a newbie to Argentina and definitely don’t feel qualified to comment on any more. I get humbled when I sit around the table at a wine bar on a Friday night and listen to the knowledge of some of my friends talk about politics in Argentina, also the school of Mr BowTiedMara gives me the same feeling. So going to leave it at that and discuss a way to play it for an investor or somebody that lives in Argentina for the low cost of living and high quality of life.

What is the bottom line for me in the short term if Milei is elected? He will try to implement his chainsaw plan in the country. Which includes eliminating the central bank, dollarising the economy, slashing public jobs, devaluing the peso (ARS), and opening Argentina to the free market. This will likely tank the economy in the short term, and foreign US dollars will still be king.

If you really wanted to hedge your cheap cost of living (thanks to the socialists) then this could be done by taking a long option on some Argentine stocks. The two that stick out to me are of course in the energy sector. One is a more leverage play and the other is a safer play out of the two. I need to pay my thanks to Kuppy, BowTiedMara, and Taylor Selden on X (Twitter) for bringing these two to my attention. Check them out below the paid content wall.

The bottom line of this article, Argentina will still likely be immediately cheap post-election if Milei’s chainsaw proposal is initiated. Patricia Bullrich is the other contender and if she wins she will initiate similar policies to Milei, just slower. If somehow the socialists win again then I go on with my time as I have over the last year under hyperinflation.

I’m going to separate some of my lifestyle content from my options trading and geologist experience content going forward, the latter being under a very cheap $8 per month subscription. Sign up if you want, no pressure, I appreciate you reading anyway.

Final note: It’s nice to have a few people reach out and tell me they’re heading to Buenos Aires as soon as the weather warms up. I’ll do a post on exactly what you need to do to reap the benefits of the cheap and quality lifestyle Argentina has to offer. I’ll write the post as such to bypass the trial and error phase I had to go through when I first arrived.

Please share this article if you think it may be of value to anyone else you know.

Cheers,

Jordan - Geólogo Trader 🇦🇺

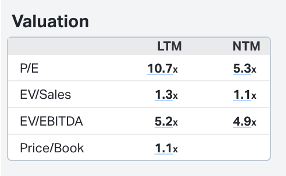

Vista Energy: NYSE: VIST

Vista Energy engages in the exploration and production of oil and gas in Latin America. The current CEO is an ex-YPF CEO (more on YPF below). Enough said (you will see why). The company’s principal assets include Vaca Muerta, Neuquina Basin, Argentina.

Vista Energy is the safer option of the two. It has a better valuation and balance sheet, and also a diversified portfolio with projects outside of Argentina. This is important if things don’t go to plan with the election as they so often don’t in Argentina.

YPF: NYSE: YPF

YPF Sociedad Anónima, an energy company, engages in the oil and gas upstream and downstream activities in Argentina. The Argentina national oil and gas company has a history of going from private and public. Being the nation's oil and gas company of Argentina, it has a large influence over Vaca Muerta. It will be privatised under Milei to clean up debt.

YPF has a ridiculously high debt load and is much more a leveraged play on the health of the Argentine economy.

Both of these companies have broken out technically since last October, and the long trade looks a bit different now, but there still could be plenty of upside remaining. Milei has indicated with “no doubt” that he wants to privitise YPF which could help reduce the debt load, and allow foreign dollars to “properly” finance the development of - Vaca Muerta, which has basically hardly been touched.

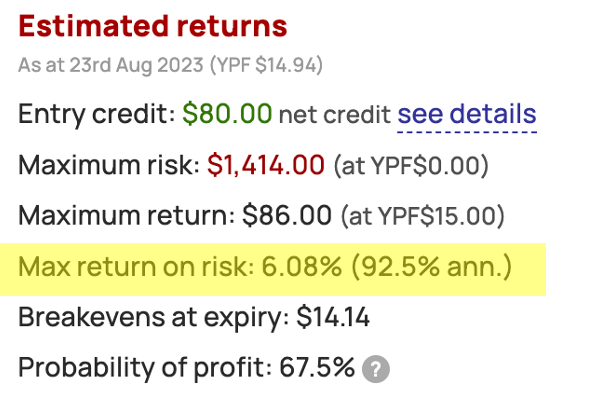

I’m toying with the idea of getting a long position in both of these companies. It would be a long VIST and an option play with YPF. I am yet to pull the trigger. I’m thinking why fuck around with extreme political risk when there are plenty of other options out there, such as in uranium and offshore drilling and services. I’m pretty much maxed out in both of these sectors. I have some bad memories of trying to trade Petrobras around the election last year.

If I was a real punter I’d have a go at some of those YPF options below. The wheel strategy (selling cash-secured puts and covered calls) would be how I’d approach it. I think Milei will win the presidency and the economic situation will eventually improve here in Argentina. In my mind, this is a good hedge against the current, socialism-induced, low cost of living which could increase with the improving economic environment.