Investing in Junior Mining Explorers: Why it's a Mug's Game.

My thoughts and stories on junior mining explorers as an ex-geologist, and where else you should focus to potentially win in the financial freedom lottery.

I have some thoughts that I believe could be useful to you regarding where to focus your time in the investing world.

Additionally, I want to run through some probability numbers so you can really grasp the risks involved with junior mining and suggest an alternative investment mindset.

This is the same investment mindset that enabled me to pack up everything, leave Australia, travel, and move to Argentina.

Recently, between $10-13 billion has been spent each year on mineral exploration, yet it would be hard-pressed to point to a dozen legitimate significant discoveries in the past five years.

Of course, it is damn exciting what could be out there and the potential value it could unlock can be life-changing - lottery-like for the shareholder.

My favourite example of junior mining exploration success is the 2012 - Nova-Bollinger discovery story as told by a very highly respected geologist - Mark Bennetts.

Nova-Bollinger was a nickel-copper-cobalt discovery of the decade in Western Australia by Sirius Resources that was sold to Independence Group for A$1.8 billion.

“We were down to the last couple of hundred thousand dollars,” Mr Bennett recalled in 2013 in an interview. “It was the final drilling campaign we could afford to do.”

Sirius Resources intersected 4m of massive nickel-copper sulphide in the final RC drill hole of the program which led to the discovery of the multi-billion dollar deposit.

Literally overnight, a large number of retail mums and dads invested in the company became paper millionaires. The share price rocketed from 5c to $5 in a matter of months.

A great exploration success story, but the purpose of this article is to highlight just how rare such a discovery is.

My time working as a project exploration geologist gave me front-row seats on how not to make money as a retail investor. Discussions with fellow smart geologist colleagues were big eye-openers to just how little money retail investors make in the sector.

Even within geologist circles - who you would think would be a great circle to be in if you’re invested in the exploration sector.

It’s quite common practice for many people involved in the sector to follow a smart geologist who has all the bells and whistles of qualifications into junior exploration stocks from the odd comment they might dish out at lunchtime.

But did I witness any of them make meaningful returns in the sector during my time working in the sector?

Nope.

Let’s explore how hard it is to make money from junior exploration stocks. The value of junior exploration stocks is largely driven by what they return from drilling.

Exploring with the drill bit is how you prove what you’re worth and ultimately do the talking via assay results from the commodity/commodities you’re exploring.

Off-topic side note: Drilling is one of my favourite parts of the mining industry and something I took great interest in while working in the industry. Many exploration geologists just want to focus on the science, you might know the type, that can be a burden to a company.

I've worked on many exploration projects, and it's always an exciting time when you see potential mineralisation in diamond drill core, RC (Reverse Circulation), and AC (Aircore) drill chips. However, this excitement often quickly turns to disappointment when assay results returned from the lab a few weeks later are not as promising as hoped.

It's important to remember that while mineralisation may be identified in the lab results, for it to be significant to shareholders is a completely different story altogether.

To really drive home this point, I'm going to focus on probability ratios.

Exploration stage: Probability = 1 in 1,000 (0.1%) of these initial prospects will become a significant mineral deposit.

Discovery stage: Probability = 1 in 10 (10%) of exploration drilling projects lead to the discovery of a deposit worth further investigation.

Resource Definition Stage: Probability = 1 in 3 (33%) of discovered deposits progress to a stage where they are considered economically viable resources.

Feasibility Study Stage: Probability = 1 in 2 (50%) of deposits that reach this stage are found to be economically viable and technically feasible to mine.

Permitting and Financing Stage: Probability = 1 in 2 (50%) of economically viable projects successfully navigate this stage.

Development Stage: Probability = 80% of projects that reach this stage are successfully developed into operating mines.

The cumulative probability of a drilling prospect becoming an operating mine is approximately 0.066% or about 1 in 1,500.

Considering the timeline, it typically takes 10-25 years before a stock returns money to shareholders. During that time, shareholders often face heavy dilution to raise capital for exploration, office expenses, and salaries. This can lead to the creation of "lifestyle companies," which are well-known in the sector.

It’s a high-risk, high-reward lottery, with the best-case scenario for a shareholder often being acquired by a mining major at a premium.

Let’s talk about my own experience with investing in the mineral exploration sector for mugs - it’s quite extensive.

Early in my professional career, I bought into the idea that there had to be another Nova-Bollinger nickel-copper deposit out in the Fraser Ranges of Western Australia.

So, I invested in Legend Mining (LEG.AX), which was heavily exploring the area.

Ultimately, the stock got too frothy, and luckily, I sold my position before they announced the next round of drill results, doubting the potential for them to successfully step out and extend mineralisation returned from the first phase of drilling.

A more recent example of this is Sendero Resources (SEND.V) in Argentina. The stock became overhyped due to its proximity to the billion-dollar Filo del Sol deposit, and, unsurprisingly, they hit nothing close to what the market expected.

Now, do I know people who held both these stocks for too long and lost money?

Yep.

Luckily for me, these investments were successful in terms of returns. The point of mentioning this in the article is to highlight that finding a deposit is incredibly challenging, and this is something both geologists and retail investors need to understand.

One instance where I got it completely wrong is with Kingfisher Mining (KFM.AX).

I want to touch on this because I know many of my followers were also following this stock.

The bottom line is that I underestimated the situation and got it completely wrong. I was confident that CEO James Farrell would steer this project successfully based on geology and results.

Unfortunately, the area and commodity fell out of favour, and it appears that board members and top shareholders were likely calling the shots, forcing him to leave the company.

Now, I’m not fully convinced the story is over for Kingfisher. They’re sitting on about $2 million in cash, and Tim Neesham (well-known investor), who has been involved since the IPO days in 2021, is still heavily engaged.

My lesson here: Against everything I learned from my mentor Trader Ferg, I heavily weighted this position and have almost completely lost it.

What I was able to learn from Ferg about halfway through my geology career was vital, and I’m certain I wouldn’t be in the position I am today if I hadn’t been so lucky.

I was able to leave my job due to the paper wealth I built up from taking calculated risks in the market - or, as Ferg likes to call it, positioning myself to get lucky.

Now, this is entirely different from investing in junior exploration stocks, where you give yourself a runway with cyclical fundamentals while investing in stocks that are priced the same as a (some) junior exploration company that has nothing but “hype”.

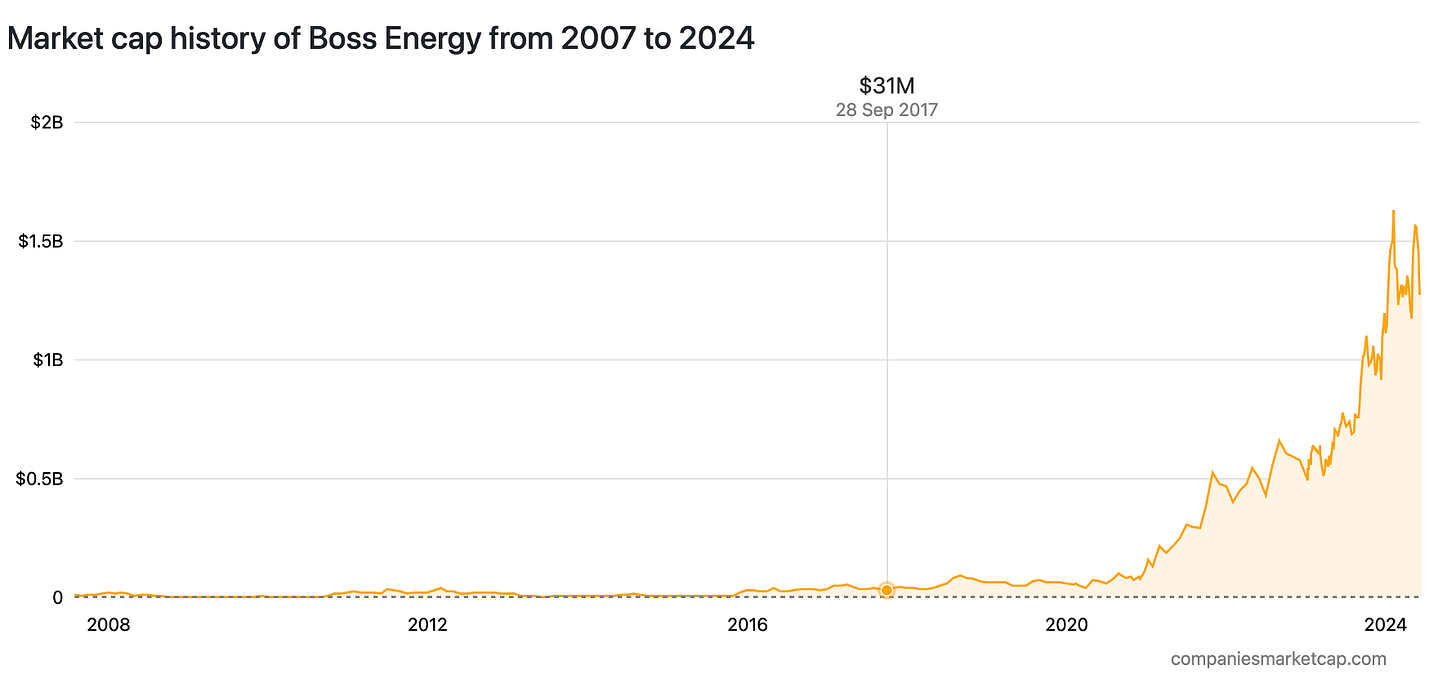

For example: I first bought shares in Boss Energy (BOE.AX) in 2017 when it had a market cap of $31 million ( I should use enterprise value (EV) as it’s usually a better metric, but a market cap chart is easier to come across).

At that time, Boss Energy had no debt and a deposit in a great jurisdiction with plant infrastructure in care and maintenance.

Now let’s look at Sendero Resources (who I mentioned earlier) and just how much “hype” it received before any drilling assay results were returned to the market.

The risks in these two stocks at a $30 million market cap are unbelievably different.

It sounds too simple, but all that could really go wrong with Boss Energy was a nuclear meltdown (the chance of a nuclear meltdown is 1 in 1,000,000,000). Albeit, in hindsight (I know I shouldn’t use hindsight), all you had to do was sit on your hands for a number of years and let the fundamentals play out.

These fundamentals include not enough uranium supply to feed the existing 10% of the world’s overall power, without even factoring in climate change targets, AI data center power requirements, SPUT launch, Japan restarts, and the lack of projects and expertise in the sector.

On the other hand, with Sendero Resources, all that could really go right is a 1 in 1000 probability odds of drilling something worth further investigation.

Now, you're probably wondering why I invested in Pampa Metals, another junior explorer. I’ve covered it a lot on here but here is a quick recap if you’re new.

My interest in Argentina's mineral exploration developed a few months ago when I identified a possible beta tailwind with Milei, hopefully, reforming all the socialist bullshit and opening up the country to prosperity. I searched around for companies with the lowest risk to invest in.

I chose Pampa Metals because they already had a significant discovery adjacent to giant idling copper deposits (Aldebaran Resources - El Altar, Glencore - El Pachón), including one producing behemoth in Chile (Antofagasta - Los Pelambras).

I’ll repeat, they already have a discovery.

At a $10 million market cap, it seemed to be the lowest risk I could find in the country for what they already had and would (very) likely return to the market through drilling.

I'm not a large risk-taker, which is why I emphasise the safety of San Juan province in Argentina. Anything likely to happen in the copper mining sector is likely to originate from here first, making it a "first mover."

This is not too dissimilar to my initial investment in Boss Energy—a safe jurisdiction with an idling deposit where anything likely to happen positively in the sector would likely see Boss Energy as a "first mover."

Summary: I was able to quit my job and live in Argentina because I created a calculated opportunity for luck in the market, which paid off to the point of the lottery returns that people are chasing with junior explorers.

Taking a calculated risk doesn’t involve investing in junior mineral explorers where the chances of a lottery payoff are something like 1 in 1,500 probability odds.

Yes, I’ve done this, such as with my investment in Kingfisher Mining. I've learned from this and now only allocate a small cash position to these sectors.

As investors in this space, please be aware of the risks and realise there are much better places with less risk to park your money if you're seeking life-changing returns.

The best advice I can give you is the advice from my mentor Trader Ferg: identify hated corners of the market that have a strong chance of becoming un-hated in the future. Of course, this is easier said than done - but it’s quite a simple investment philosophy at the end of the day.

I love it when I ask Ferg in our monthly mentor chats about junior exploration companies and he just says to me “Why bother”.

Currently, my strongest conviction sectors are uranium, offshore drillers, coal, oil, and Argentina's first movers in copper in “safer jurisdictions”.

Thanks for reading.

I hope you are enjoying the content.

Please consider leaving me a like or comment with your thoughts.

Cheers,

Jordan - Geólogo Trader 🇦🇺

Great post, it is really hard to make money on the junior sector when there is so much risk involved. I found your blog because I found the company Pampa Metals and I invested on them, I was searching to see who else was talking about them on the internet and I found your post.

From my years of experience, nowadays I just invest on companies after having a discovery, never on the exploration phase (this is the most risky where mostly of the companies die). So it is necessary to have the discovery and the follow up holes. I check mineralization (always try to see photos of the core, if they don’t release photos can be a red flag) to see if it seems to be continuous, the way that they release the composites to see if they are smearing (if they don’t release individual assays depending on the kind of deposit it can be a red flag) or if it is really continuous down hole. Continuity along strike is also necessary to check to see potential volume. Also geopolitical risky, it is very important to keep in mind that the right deposit in the wrong place is not appreciated by the market.

In my opinion to invest in this sector it is very important to look at a lot of companies to be able to know what is the fair price of the company based on the stage that they are, based on what they already have achieved. It is like buying a property in a city that you are not familiar with, you need to looks at many options to be able price it and decide if it is cheep or expensive.

What is your top 4 companies that you believe are a good investment in the long term?

Great write-up. Thank you. Also started to follow Trader Ferg recently :-). When thinking about investments into more stead businesses I can recommend listening to podcasts by Mohnish Pabrai, who copied his investment approach from Buffet and Munger and has a similiar approach to find hated industries. Hes big in met coal, too.