Pampa Metals - Why I am Deeper Involved Now.

"There could be a couple of billion tonnes of copper resource at Cobrasco" - why I’m going all in on this opportunity after visiting the Colombian jungle.

For those of you interested in mining and exploration in South America, I've taken on another part-time role with Pampa Metals as their Investor Relations Advisor. Given the big recent news about the company lately, I'm damn excited to be part of it all.

Pampa Metals is acquiring Rugby Resources through a share exchange.

Pampa Metals will issue 1 Pampa share for every 6 Rugby shares held, acquiring an 80% interest in the Cobrasco copper-moly porphyry project in Colombia, and 100% ownership of the Mantau IOCG exploration project in Chile.

Once the acquisition wraps up, the combined market cap of Pampa Metals and Rugby Resources should land around C$21 million (Pampa’s about C$14M + Rugby’s around C$7M). Rugby shareholders will end up owning roughly 38% of the new combined company.

So, post-acquisition, we’re looking at Pampa having a market cap of about C$20M.

Here is the story I can finally write about and why I see tremendous value in being apart of it as a shareholder,

It was only a few weeks ago, when Joe (Pampa's CEO) invited me along on a site visit to Cobrasco to do some due diligence before Pampa potentially acquired the project, it couldn't have been a quicker "yes" from me.

Cobrasco is honestly one of the most exciting porphyry copper discoveries globally. I've heard Vukasin Pekovic talk about it on various podcasts and gone through his detailed reports, and Tom Woolrych from Deutsche Rohstoff showing me a Leapfrog model. From two and a half drill holes, we're roughly likely already looking at a couple to a few hundred million tonnes grading around +0.40% copper.

Enough said - for me this stage.

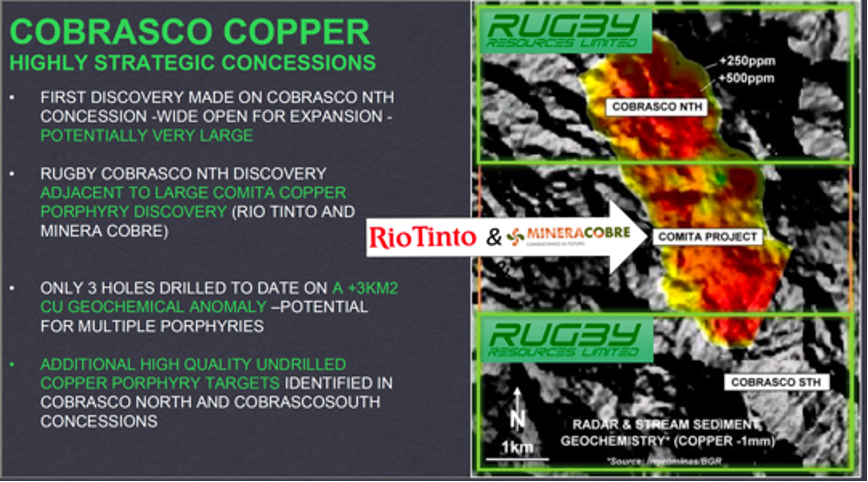

What's even more interesting is that a few kilometers away from MCC/Rio Tinto's Comita project, where they’ve hit significant copper grades. It’s probably all the same big porphyry system.

So, bottom line: At Pampa Metals we think Cobrasco is huge.

Rugby’s geologist’s have done some excellent technical work out there and I was dead set very impressed by their level of professionalism.

The challenge here isn't in the geology and copper mineralisation potential, never has been.

Why wasn’t Cobrasco drilled and developed back in the day? The answer is simple: it’s located in the western Colombian jungle, specifically in the Chocó department, and lies within a forestry reserve.

Chocó is predominantly an Afro-Colombian region and is among the poorest areas in the country. Despite these challenges, Rugby Resources has done very well and successfully established a 10-year community agreement with local residents and secured all necessary permits for exploration drilling.

On site in Chocó, the reception towards a funny-looking 6’6” blonde foreigner (me) and Joe was about as warm as it gets, with everyone very friendly.

At Pampa Metals, we believe the project is now well-positioned and ready to proceed with additional drilling.

There’s no need to wait or rely on a federal change of government, which is highly likely (90%) to occur next year. We plan to focus on recommencing drilling at Cobrasco immediately after the Austral summer and the conclusion of the field season at Piuquenes—the company’s flagship project in San Juan, Argentina.

The project requires helicopter-supported drilling due to its remote location and challenging access, but it’s only a 15-20 minute flight from the city of Quibdó—the capital of the Chocó department in Colombia, where Rugby Resources' coreshed, accommodation and finca are located. MCC/Rio Tinto's nearby Comita project faces similar logistics.

Here are the world class copper intercepts from those initial 2.5 drill holes in 2022, demonstrating just how spectacular the potential is:

CDH001

808m @ 0.42% Cu (copper) (184m-992m)

CDH002

754m @ 0.46% Cu (152m-906m)

CDH003

144.6m @ 0.69% Cu (156m–300.6m (EOH) ended early for various reasons and in copper serious +2% Cu juice.

One big thing to notice, these are NOT CuEq values.*

One significant factor in all this is that MCC (Minera Cobre Colombia), in a joint venture with Rio Tinto, is currently drilling with two diamond rigs immediately to the south of Cobrasco. Here's photographic evidence from a low pass we made by helicopter during our recent site visit.

What's the X factor here at Cobrasco to get things progressing?

Joseph van den Elsen.

Joe is Australian but also a Colombian citizen, having lived in the country for a decade. Through his various ventures, he's backing himself to get Cobrasco up and running.

Just to be clear for investors: It's Pampa's current understanding that we can recommence drilling at Cobrasco as soon as we turn our attention to it.

What do you reckon will happen to the stock when drilling gets underway at one of the world's most exciting porphyry discoveries?

Also, something that might get overlooked: Bryce Roxburgh (Rugby Resources CEO and major shareholder) is joining the board at Pampa Metals as part of the acquisition.

Bryce is one of the most successful mining executives out there, having led not just one, but two major acquisitions in South America—Extorre Gold Mines (Cerro Moro) and Exeter Resource Corp. (Caspiche). If you know, you know—a dead-set legend in the space.

Flagship Piuquenes project in San Juan, Argentina.

I was fortunate enough to attend a FinTwit meetup in Buenos Aires alongside a group of well-known investors who were touring Aldebaran’s El Altar project. Hearing their insights and the compelling investment case for Aldebaran Resources was incredibly valuable, particularly given the potential to leach sulphides on leach pads for high recovery using Nuton/Rio Tinto technology. This could be a game-changer. Anyone familiar with porphyry deposits will understand the significance of this innovation.

All this has me even more excited about Pampa’s flagship Piuquenes project, which sits directly adjacent to Altar.

Here are the world-class copper-gold hits at the Piuquenes Central porphyry since Pampa acquired the project in 2023:

PIU01-2024DDH

422m @ 0.48% Cu, 0.61 g/t Au (gold) (198m-620m)

PIU02-2024DDH

448m @ 0.42% Cu, 0.46 g/t Au (214m-662m)

PIU03-2024DDH

801m @ 0.40% Cu, 0.51 g/t Au (54m-855m (EOH))

PIU16-01DDH

558m @ 0.38% Cu, 0.42 g/t Au (362m–920m (EOH))

Aldebaran’s progress at El Altar is an added bonus for Piuquenes. While Piuquenes stands on its own as a strong project, having a billion-tonne development right next door—just over the hill—backed by Rio Tinto and led by John Black, who has a track record of getting projects sold, only strengthens the investment case.

I’m looking forward to the upcoming PEA (this year) at Altar to see how the IRR compares between the Nuton solution and traditional CIL sulphide processing methods.

The Piuquenes Project has two mineralised porphyries on the property, it’s the companies flagship project and hold huge potential with it being directly adjacent to Aldebaran Resources’ +C$300M market cap El Altar project.

Summary.

Pampa Metals will acquire three quality projects in South America, with Rio Tinto as a neighbour for two of them—Piuquenes and Cobrasco.

The flagship project, Piuquenes, has two mineralised porphyries on the property and is located adjacent to Aldebaran's giant El Altar project. Aldebaran has one of the strongest team in the sector with a proven track record of doing it all before.

Cobrasco is one of the most exciting porphyry copper discoveries globally. Pampa CEO Joe is personally backing the project, leveraging his extensive Colombian business experience to restart drilling and advance the project.

The third project, Mantau, located in Chile, is currently in the pre-drilling exploration phase. Recent drilling results from its significant neighbour, Marimaca Copper, released in December, showed low to mid-grade copper oxide mineralisation hosted in andesitic volcanics. This makes Mantau highly prospective, underscoring its exploration potential in a prime copper district in Chile. This project certainly shouldn't be overlooked.

Having personally visited both Cobrasco and Piuquenes (multiple times), I’ve seen Joe in action and fully back him to lead this acquisition. I genuinely believe he’s the right person to advance these projects and deliver significant shareholder value.

Don’t forget, serious mining legend Bryce Roxburgh is still hanging around and joining the Pampa board—a huge factor here.

Having Tony Manini from EMR Capital involved in a personal capacity, along with Rob Cohen from 1832 Asset Management as major shareholders, is a huge vote of confidence.

Once Pampa Metals lists on the TSX-V and then the ASX, and plans to get drill rigs turning at Cobrasco, further advances the two porphyry systems at Piuquenes, and starts exploration at Mantau, its current market cap of around ~$14M - before finalising the Rugby Resources acquisition - it doesn’t get much more of a steal than that to me.

It can’t get onto the TSX-V soon enough. Being on the CSE is a significant hurdle holding many retail investors back, as a lot of people don’t have access. It’s easily the question I get asked most often.

I’m excited to be fully involved and to see how all of this ages with time.

Cheers,

Jordan - Geólogo Trader 🇦🇺

Disclaimer: This includes forward-looking statements and opinions after personal project site visits. I have a vested interested in Pampa Metals, I hold stock, am participating in the current open private placement, and have a part-time role as Investor Relations Advisor. Please DYOR.

Side note for loyal Geólogo Trader subscribers:

I recently visited my second home in Asunción, Paraguay. It was fantastic, and yep—I got some funny looks standing in the ‘Paraguayans Only’ immigration line while using my newly acquired residency card to enter the country.

During the trip, I had a great meeting with a Paraguayan senator, who gave me a personal tour of the congress building and shared some unbelievable yet unsurprising insights about the country. It's amazing what opportunities posting on social media can open up—just do it!

I'm halfway through writing an article to update you all on my slow and complicated path with internationalisation, my US LLC, and how I'm managing my business affairs abroad.

I've decided to change my approach after navigating quite a few hurdles—especially given how challenging it has been to move my shares out of Australia. More details soon if you’re interested!

Have a good weekend.

Good stuff Jordan! I would think that is the perfect gig over there for you. Investor Relations. I've had a few of them reach out over the years and it seems a good gig for those who have some technical knowledge (you have plenty) but that can also appreciate both perspectives being company and investor. Bravo!

Thank you for your response Jordan. I wish you much success in all your endeavors, particularly with the Rugby/Pampa hookup. I hope Joe has some powerful connections.